- 27 October 2022

- 15 September 2022

Payment Linked Loyalty – Under the Hood

- 15 September 2022

## What are hackathons?

- 6 September 2022

The data is in the details – the Bink difference

- 15 August 2022

What if almost half the British public saw your brand?

- 4 August 2022

Loyalty and the cost-of-living crisis

- 29 July 2022

What would happen if we stopped using plastic?

- 15 July 2022

Uni Work VS Work Life

- 5 July 2022

Retail Newsflash

- 1 June 2022

Technology in the Elizabethan Age

- 11 April 2022

A brief history of payments and loyalty

- 17 March 2022

How Green was my Loyalty?

- 7 March 2022

Women in Technology

- 23 February 2022

Bink for Bar Magazine

- 16 February 2022

The UX of Digital Loyalty in Banking Apps

- 2 February 2022

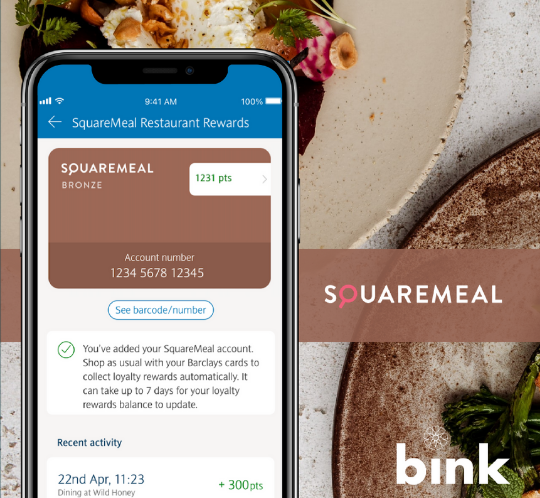

Interview with SquareMeal

- 2 February 2022

Bink and SquareMeal Press Release

- 13 January 2022

Engineering Culture

- 6 January 2022

Bink Award: Top 5 Retail Tech Companies in the UK 2021